New Home Construction Finance

Dave Pettitt – Mortgage Planner

Building a New Home

Building a new home can be an exciting prospect – Because building a new home can be daunting, choosing the right agent, builder, architect, engineer, and construction loan partner is critical to ensure that the process goes as smooth as possible. Visit our partner page to find some of our experienced and preferred vendors. We will work with you and your team to gather your plans, cost breakdown, and other applicable items to begin the construction loan process.

Great spot for an “Required Construction Docs” graphic: Plans, Cost Breakdown, Land Contract, Build Contract, Builder license and Insurance.

There are two main types of residential construction loans:

One-Time Close (less used): You borrow one-time to pay for construction. When you move in, the lender converts the loan balance into a permanent mortgage. This is essentially two loans in one which can save a little in up-front costs. The drawback is that payments are usually due during the course of construction based off of variable rates, and your fixed rate end mortgage usually is locked at a significantly higher rate than current market. Generally a minimum down payment of 20% is required.

Stand-alone construction: Your first loan pays for the course of construction. Typically your lot is paid with the very first draw and interest is only incurred on the drawn amount. No payments are due over the course of construction. When construction is complete and you’re ready to move in, we write a permanent/long-term mortgage to pay off the original construction loan. These are two separate loans. Funding sources are always changing guidelines due to market conditions but usually with this loan type we will finance up to 90% of the total cost of the project, at 80% Loan to Value. That means you either buy into some equity, create equity through lower construction costs, or the builder defers profit (most common) until the long-term financing is completed to bridge that 10% gap. One major benefit is that the long-term financing is based off of the current value at completion rather than the acquisition costs. For many that means being able to get out of Private mortgage insurance (PMI) without having to put 20% down.

A stand-alone construction loan can work out well allowing you to make a smaller down payment. That can be a major advantage if you already own a home and don’t have much cash for a down payment but you will have more cash after you sell your home. You can live in your current home while your next home is under construction.

The drawbacks could include paying some closing fees twice; first, on the construction loan; second, on the permanent mortgage. If rates rise during construction, you might have to pay a higher-than-expected interest rate on the permanent loan. If your financial circumstances change for the worse during construction, you may find it difficult or impossible to qualify for a long-term mortgage.

Regardless of loan type, you’ll want to be very conscious of costs and changes throughout the course of construction. Cost overruns are often incurred when borrowers change their minds about what they want as construction proceeds. Getting to far outside of your budget can derail the process and cause complication at every stage.

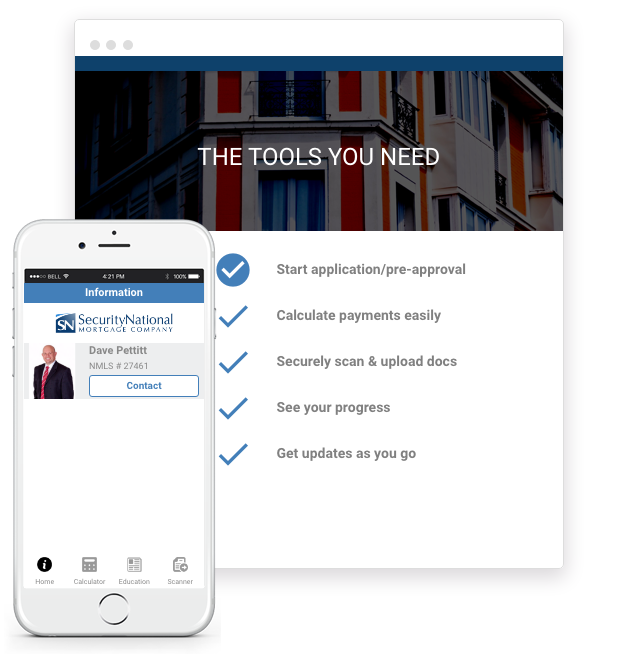

A modern mortgage experience.

Get pre-approved fast.

Get pre-approved, view your progress, scan and securely upload documents with your mobile device, sign electronically, and message your LO easily as you go.

CONTACT US.

Fill out the form below and we will be in touch with you shortly to schedule a free mortgage planning consultation.

START PLANNING.

Dave Pettitt and his team are ready to help you get started. Learn more about our loan options, interest rates, and more.

(801) 508-6300

6975 Union Park Center Suite #420

Cottonwood Heights, UT 84047

Branch NMLS# 1148585