VA Mortgage Loans

Dave Pettitt – Mortgage Planner

VA Mortgage Loans

Loan Programs for U.S. Veterans

The VA Loan became known in 1944 through the original Servicemen’s Readjustment Act also known as the GI Bill of Rights. The GI Bill was signed into law by President Franklin D. Roosevelt and provided veterans with a federally guaranteed home with no down payment. This feature was designed to provide housing and assistance for veterans and their families, and the dream of home ownership became a reality for millions of veterans. The GI Bill contributed more than any other program in history to the welfare of veterans and their families, and to the growth of the nation’s economy.

With more than 25 million veterans and service personnel eligible for VA financing, this loan is attractive and has many advantages. Eligibility for the VA loan is defined as Veterans who served on active duty and have a discharge other than dishonorable after a minimum of 90 days of service during wartime or a minimum of 181 continuous days during peacetime. There is a two-year requirement if the veteran enlisted and began service after September 7, 1980 or was an officer and began service after October 16, 1981. There is a six-year requirement for National guards and reservists with certain criteria and there are specific rules concerning the eligibility of surviving spouses.

VA guaranteed loans are made by private lenders, such as banks or mortgage companies, for the purchase of a primary residence (1-4 units). These loans offer competitive rates and often require $0 down payment. There is no monthly mortgage insurance on a VA loan however, the VA does charge a “funding fee.” This fee can be financed into the loan as long as the loan amount is at or below the conforming loan limits for the county where the home is located. The exception to having to pay the VA funding fee would be if a Veteran is exempt through disability. Funding Fees may be found at this link: https://www.benefits.va.gov/homeloans/documents/docs/funding_fee_table.pdf

While there is technically no limit to the amount of a VA mortgage, the VA will only guarantee a maximum of 25 percent of a home loan amount up to $113,275, based on the conforming loan limit of $453,100. (may be higher in some high-cost counties) Should you want to borrower more than the limit, you would be responsible as a buyer for 25% of the balance above the conforming loan limit plus the funding fee. E.g. $500,000 loan – $453,100 loan amount = $46,900 x .25 = $11,725 plus the funding fee would be due from the borrower at closing.

Being a veteran doesn’t make a homebuyer automatically eligible for a home loan, you must meet both service requirements and credit/income requirements to be eligible.

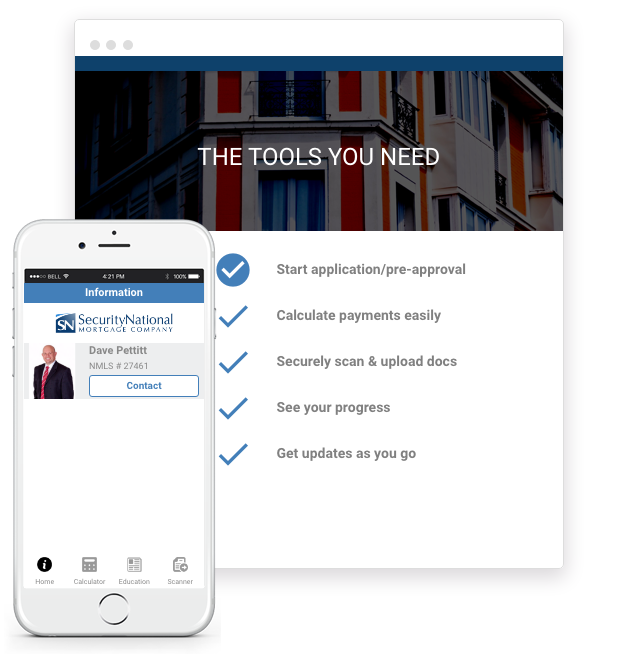

A modern mortgage experience.

Get pre-approved fast.

Get pre-approved, view your progress, scan and securely upload documents with your mobile device, sign electronically, and message your LO easily as you go.

CONTACT US.

Fill out the form below and we will be in touch with you shortly to schedule a free mortgage planning consultation.

START PLANNING.

Dave Pettitt and his team are ready to help you get started. Learn more about our loan options, interest rates, and more.

(801) 508-6300

11240 River Heights Drive Suite 100

South Jordan, UT 84095

Branch NMLS# 1148585