Conventional Loan Programs

Dave Pettitt – Mortgage Planner

Utah Conventional Home Loans

A conventional loan is a mortgage that is not guaranteed or insured by any government agency, including the Federal Housing Administration (FHA), the Farmers Home Administration (FmHA), The US Department of Agriculture (USDA) loans, and the Department of Veterans Affairs (VA). These loans are typically fixed in their terms and rates (however variable rate options do exist like 7/1, 5/1, 3/1 Adjustable Rate Mortgages ARMs) and can be obtained with as little as 3% down. Conventional loans can be used to finance 2nd homes, investment properties, Single Family Residences, and Condos.

Conventional loans may include:

Conforming Loans

Non-Conforming Loans

Jumbo Home Loans

Portfolio Loans

Sub-Prime Loans

Conforming Mortgages

Most conventional loans today are called “conforming” mortgages, because they conform to guidelines established by Fannie Mae and Freddie Mac. These two government-sponsored enterprises (GSEs) buy mortgages from lenders and sell them to investors. Their purpose is to make mortgages more widely available. All conforming mortgages are also conventional mortgages.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is required on all “Conforming” loans where the borrower puts down less than 20%. However, PMI can be paid in a variety of way. For example, it can be paid in the form of monthly premium, a single pay 1 time premium at closing, The Lender can pay it (usually comes with a higher interest rate), or you can pay some upfront and some as you go (Split Premium.)

Non-Conforming Loans

Loans that do not conform to GSE guidelines are referred to as “non-conforming” home loans. Non-conforming loans that are larger than loan limits set by the GSEs are often referred to as “jumbo” mortgages. All non-conforming mortgages are also conventional mortgages.

Portfilio Loans

Conventional loans held by mortgage lenders on their own books are called “portfolio” loans. Because lenders can set their own guidelines for these loans and do not sell them to investors, these products may have features that other mortgages do not.

Sub-Prime Mortgages

Conventional home loans marketed to borrowers with low credit scores are called sub-prime mortgages. They typically come with high interest rates and fees. The government has created special rules covering the sale of such products, but they are not government-backed — they are conventional loans.

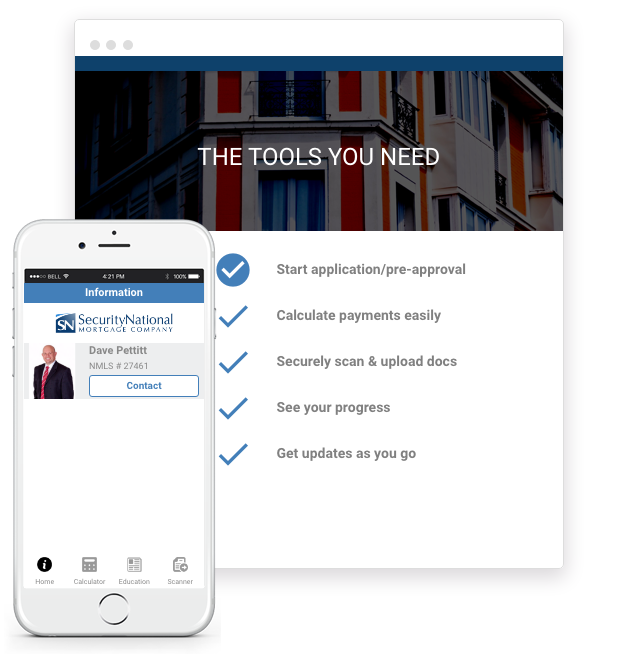

A modern mortgage experience.

Get pre-approved fast.

Get pre-approved, view your progress, scan and securely upload documents with your mobile device, sign electronically, and message your LO easily as you go.

CONTACT US.

Fill out the form below and we will be in touch with you shortly to schedule a free mortgage planning consultation.

START PLANNING.

Dave Pettitt and his team are ready to help you get started. Learn more about our loan options, interest rates, and more.

(801) 508-6300

11240 River Heights Drive Suite 100

South Jordan, UT 84095

Branch NMLS# 1148585